Rising costs and years of uncertainty pushed many U.S. furniture buyers away from Chinese suppliers. But in May 2025, the policy landscape changed again—and this time, in our favor.

The U.S. has suspended 24% of the additional tariffs on Chinese furniture. As of today, importers are paying just 10%—a sharp drop from last year’s 34%.

This is more than a tax cut. It’s a renewed opportunity to reconnect with a reliable and proven supply chain—at the perfect time.

What Are the U.S. Tariffs on Chinese Furniture in May 2025?

The past few years were tough for importers trying to manage high landed costs and price uncertainty.

In May 2025, the U.S. reduced tariffs on Chinese furniture imports to 10%1 by suspending 24% of the previously imposed additional duties.

How the New Tariff Rate Works

Background:

Since 2018, Section 301 tariffs on Chinese furniture raised import costs by up to 34%. That included a 10% permanent rate and an added 24% from executive trade orders.

On May 5, 2025, the U.S. Trade Office announced a 90-day suspension of the 24% tariff. This means importers now pay only the 10% base rate.

Implications:

| Period | Tariff Rate on Furniture |

|---|---|

| 2023–Early 2025 | 34% (10% + 24%) |

| May 2025–Jul 2025 | 10% only |

| After July 2025 | Pending further talks |

While the change is temporary, it opens a window for importers to restock at a lower landed cost. This directly improves gross margins and gives breathing room on pricing.

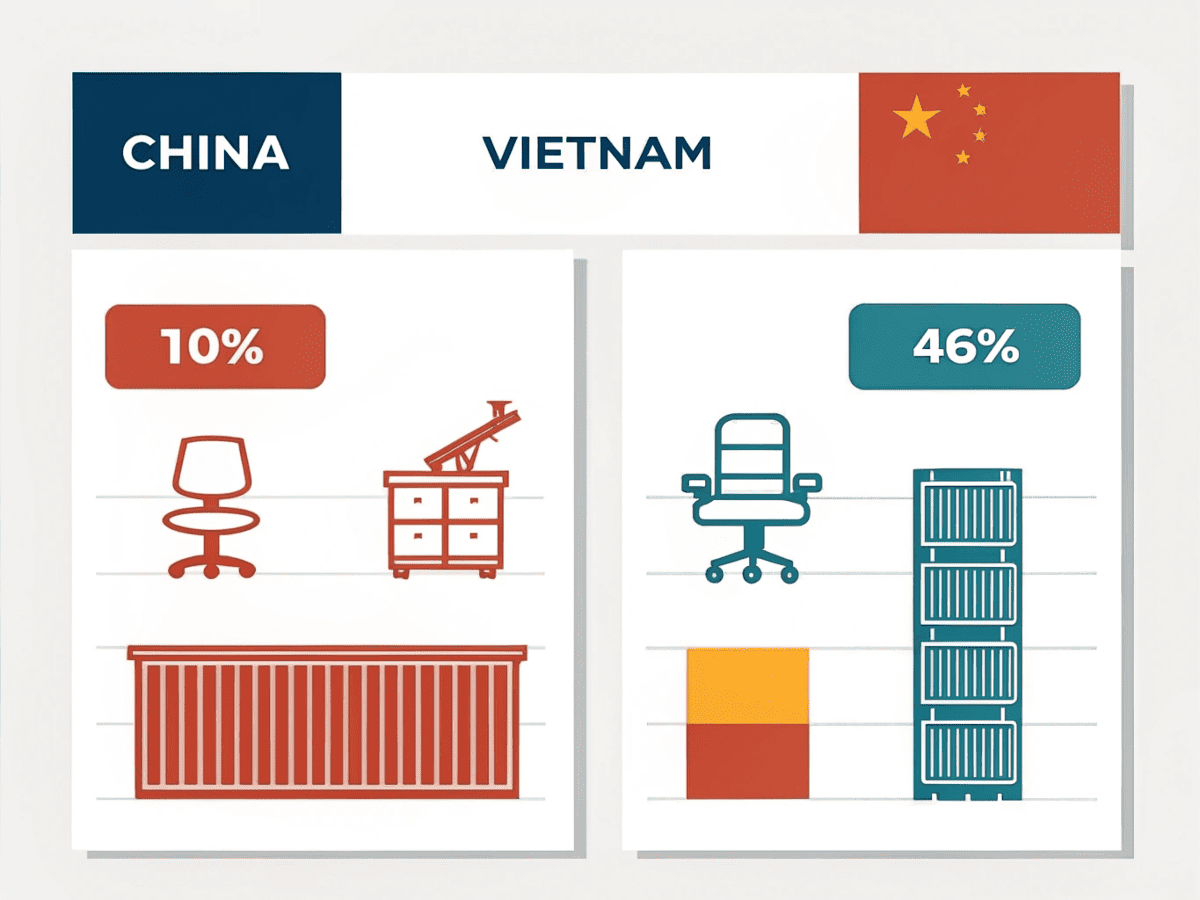

Is It Cheaper to Import Furniture from China or Vietnam Now?

Buyers often compare China and Vietnam when tariffs change. But price is never the full story.

In May 2025, China has become the more cost-effective source—because Vietnam is now facing a 46% reciprocal duty2.

Cost Isn’t Just FOB—It’s Total Landed Price

Current Tariff Breakdown:

| Country | MFN Base Tariff | Additional Tariff | Total |

|---|---|---|---|

| China | 0–4% | 10% | ≈10–14% |

| Vietnam | 0–4% | 46% (as of Apr 2025) | ≈46–50% |

Other Factors:

- Vietnam faces supply chain bottlenecks and limited capacity for mesh or ergonomic chairs.

- Many Vietnamese factories rely on imported parts—from China.

Bottom Line:

FOB prices from Vietnam may look similar or slightly lower, but the real landed cost (after tariffs, delays, and risks) is significantly higher.

How Can U.S. Buyers Benefit from the New Tariff Policy?

The new policy isn’t just about saving a few dollars per chair.

It’s about improving profitability, planning with more confidence, and regaining flexibility in sourcing.

This Is the Time to Act

Three Major Advantages:

-

Cost Clarity3

With tariffs at 10%, landed cost is predictable again. You can plan pricing without last-minute surprises. -

Rebuild Inventory Smartly4

If you reduced China orders last year, now is the time to fill the gap. Lead times are steady and volume production is back. -

Reengage Your Factory Relationships

The policy change is also a signal: U.S.–China trade is stabilizing. Rebuilding supplier connections now helps secure better support long-term.

Our Tip:

Many large buyers are already moving. Those who act in Q2–Q3 2025 will likely secure better booking slots and avoid capacity surges later in the year.

Why China Still Offers the Best Value Supply Chain for Furniture5

For serious importers, the question has never been about who’s the cheapest—it’s who can deliver consistently.

Even with tariffs, China remains the strongest furniture export ecosystem in the world.

5 Key Supply Chain Advantages:

| Factor | China | Vietnam |

|---|---|---|

| Lead Time | 25–35 days | 45–60+ days |

| Product Range | Office chairs, recliners, mesh, task chairs | Mostly wood furniture, limited mesh or ergonomic |

| Testing Capability | BIFMA, SGS, in-house QC | Limited certification scope |

| Parts Integration | Injection, metal, upholstery | Often outsourced |

| Communication Speed | Fluent English teams, fast samples | Slower response, trade agents |

China’s scale gives us room to experiment, automate, and deliver fast—even when the market shifts. For U.S. buyers who want peace of mind in production, China still leads.

How QYRASIEL Helps U.S. Importers Cut Costs and Lead Times

I understand what matters to U.S. buyers—not just pricing, but reliability, speed, and documentation.

At QYRASIEL, we’ve worked with importers across the U.S. for more than 15 years, including during trade war and recovery cycles.

Our Advantages for American Buyers:

-

In-house Injection Workshop

We mold chair parts ourselves, so we control the timeline and quality. -

Certified Quality

All chair components meet BIFMA standards. Several finished models have already passed full BIFMA tests. -

Mixed Container Support

You can ship 3–5 models in one container without additional fees. That means less inventory pressure. -

Fast Sampling and Quotation

We can turn around new samples in 5–7 days and provide updated landed cost breakdowns for your product list. -

Private Label Ready

We offer logo branding, color customization, and barcode-ready packaging.

We don’t just assemble chairs—we engineer solutions for U.S. distributors who need dependable products and responsive service.

From the Owner: Why We’re Ready for the U.S. Market

We’ve supplied products to U.S. buyers before—so we understand what your market expects. From comfort standards to packaging, from BIFMA testing to shipment consolidation—we’ve been there, and we’ve delivered.

At QYRASIEL, we produce our own chair components in-house, thanks to our dedicated injection-molding workshop. This gives us better cost control, faster lead times, and tighter quality standards.

Most importantly, all our chair parts meet BIFMA standards, and several of our best-selling models have already passed full BIFMA testing.

We don’t just assemble chairs—we engineer them for performance, compliance, and the kind of durability U.S. buyers expect. Whether you need support for private label, custom components, or long-term programs, we’re ready to build the right products for your market.

Conclusion

The easing of U.S.–China tariffs in 2025 is more than just a policy update. It’s a green light for U.S. furniture buyers to re-enter the China supply chain with renewed confidence.

With only 10% tariffs in place—and with Vietnam now facing 46%—the numbers speak for themselves. But the real value lies in working with a factory that understands your business, your deadlines, and your expectations.

At QYRASIEL, we’re not starting from scratch. We’re continuing with strength.

Let’s reconnect. Let’s restart. Let’s grow together.

-

Understanding the latest tariff rates can help importers make informed decisions and optimize costs. ↩

-

Exploring this topic reveals how tariffs affect sourcing strategies and pricing in the furniture market. ↩

-

Understanding cost clarity can help buyers make informed decisions and avoid unexpected expenses. Explore this link for deeper insights. ↩

-

Rebuilding inventory smartly is crucial for maintaining supply chain efficiency. Discover strategies and tips to optimize your inventory management. ↩

-

Exploring China’s supply chain advantages can help buyers understand why it remains a top choice for furniture sourcing. Learn more about these benefits. ↩